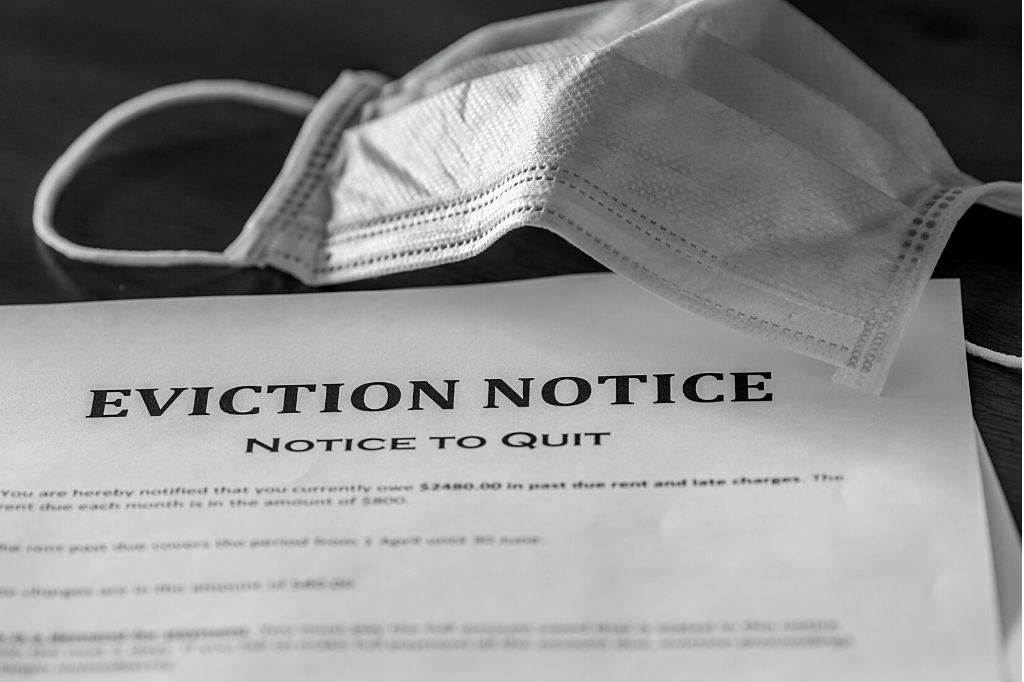

UPDATE: EVICTION MORATORIUM CONTINUES – WHAT IT MEANS FOR LANDLORDS

The CDC eviction moratorium halting evictions was extended through at least June 30, 2021. This blog post will explain what the eviction moratorium means for landlords. You can view the full official CDC media statement here.

What does the eviction moratorium do?

The eviction moratorium prohibits a landlord from removing a covered tenant from a residential rental property for non-payment of rent before June 30, 2021.

The eviction moratorium prohibits any action by a landlord, owner, or other person to remove or cause the removal of a covered tenant from the residential property for non-payment of rent.

Any action that causes the removal of a covered tenant is defined as an eviction under the CDC’s order, except if the residential property is foreclosed on. This includes legal attempts to evict a tenant, such as filing an eviction, and illegal attempts to evict a tenant, such as locking out a tenant or shutting off utilities.

The eviction moratorium provides only 5 circumstances when a landlord may evict a covered tenant. A landlord may remove a covered tenant who is:

- Engaging in criminal activity on the premises

- Threatening the health and safety of other residents

- Damaging or posing an immediate and significant risk of damage to property

- Violating a health and safety code or regulation

- Violating a term of the lease, other than non-payment of rent or fees such as late fees

Removing a tenant for any other reason will violate the eviction moratorium. To see more FAQ’s about the eviction moratorium as answered by the CDC please visit here.

Do covered tenants still have to pay rent?

Yes, the eviction moratorium does not relieve tenants of the obligation to pay rent. Tenants who are not able to pay full the amount of rent should be making partial payments if they are able to do so.

The moratorium does not “cancel” rent. Tenants will still owe rent for the unpaid months, but cannot be evicted before March 31, 2021 for not paying.

It also does not prohibit a landlord from charging late fees or other charges related to non-payment of rent. However, a landlord cannot evict a tenant for failing to pay the late fees or other charges related to the non-payment of rent.

What properties does the eviction moratorium apply to?

The eviction moratorium applies to all residential rental properties. Even those properties that were not covered by the CARES Act eviction moratorium. The moratorium covers a qualifying tenant, not the rental property.

When is a tenant covered by the CDC eviction moratorium?

A tenant must meet 5 requirements to be covered by the eviction moratorium:

The tenant cannot pay full rent. The tenant is covered if they cannot pay full rent due to financial hardship, including:

- Substantial loss of household income,

- Loss of compensable hours of work,

- Loss of wages,

- A lay-off, or

- Extraordinary out-of-pocket medical expenses. The hardship does not have to be related to the COVID-19 pandemic.

The tenant meets income requirements. The tenant is covered if they:

- Expect to earn no more than $99,000 in annual income for 2020 or no more than $198,000 if you are filing a joint tax return, or

- Were not required to report any income in 2019 to the IRS, or

- Received an Economic Impact Payment (stimulus check) under the CARES Act

The tenant is making their best effort to pay rent.

- The tenant should be making their best effort to make partial payments as their circumstances allow.

- If a tenant’s circumstances do not allow them to make partial payments, they can still meet this requirement and be covered by the eviction moratorium.

- The tenant must make their best effort to obtain all available government assistance for rent and housing. The tenant should try to obtain all available assistance, including:

- Calling 2-1-1 or visiting here.

The tenant has no other available housing. The tenant is covered if an eviction would likely:

- Make them homeless, or

- Force them into a congregate living situation (such as a homeless shelter), or

- Force them into a shared living situation (such as sleeping on a friend or family member’s couch.)

Housing is only considered “available” if it is unoccupied, safe, and will not increase the tenant’s housing costs. A tenant cannot be forced into housing that is unsafe, unaffordable, or would force them into a shared living situation.

What must a tenant do if they are covered?

If a tenant is covered, they must sign a declaration under oath stating that they are covered and give you a copy of the signed declaration.

The declaration is available on the Housing Solutions website under Landlord Resources.

As a landlord, you must tell a tenant in writing the name and address of the manager, owner, property manager, or other person who must accept written notices such as this declaration from a tenant. If that person has changed, you should give an updated written notice to your tenants so your tenants can provide the declaration to the correct person.

What happens if a landlord violates the eviction moratorium?

A landlord who violates the eviction moratorium is subject to criminal penalties, including fines and jail time. Violations will be prosecuted by the United States Department of Justice.

An individual landlord violating the order may receive:

- A fine of up to $100,000, one year in jail or both

- If the violation results in a death, the fine can be increased to up to $250,000

An organization violating the order may receive:

- A fine of up to $200,000 per violation

- If the violation results in a death, the fine can be up to $500,000 per violation

I’m struggling to pay my bills because my tenant isn’t paying rent. What can I do if I cannot evict them?

Request Mediation:

- You can request free mediation services from the Early Settlement Mediation Program to resolve disputes with your tenant, including non-payment of rent.

- Call 918-596-7786 or complete an intake form available here.

Apply for Rental Assistance:

- Landlords can find out about additional rental assistance programs by calling 2-1-1 or visiting here.

- Talk to Your Mortgage Servicer:

- Your property may qualify for protections under the foreclosure moratorium.

- If you are struggling to pay your mortgage due to loss of rental income, you should speak with your loan servicer.

- You may be entitled to a forbearance, which allows you to temporarily suspend or reduce your monthly mortgage payments.

Talk to a Lawyer:

- If you have questions about what your rights and obligations are as a landlord, you should speak with a lawyer.

- If you are not currently represented, brief legal advice and “know your rights information” is available through the Landlord Tenant Resource Center at 918-218-4138.

- The Tulsa County Bar Association (TCBA) Lawyer Referral Program can refer you to a lawyer who will advise you on what your rights are, what legal options are available to you and, if necessary, arrange for further legal work. To contact the TCBA Lawyer Referral Program, call 918-587-6014 or visit here.